(authored by RSM US LLP) Intercompany transactions are common and complex, but successfully managing them is critical for the accuracy and integrity of financial statements.

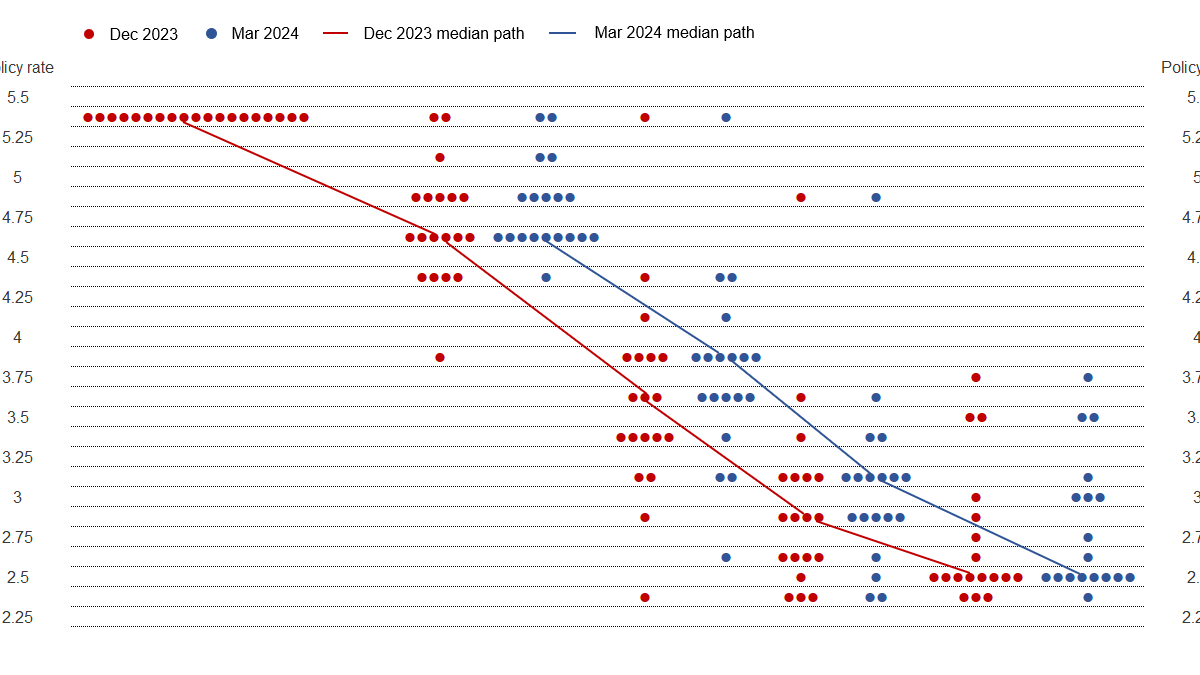

Continue readingFed holds rates steady as it implies three rate cuts in 2024

(authored by RSM US LLP) The primary takeaway from the Federal Open Market Committee’s policy statement and forecast is that the Fed, along with other major central banks.

Continue readingTax relief bill passes House, faces uncertain fate in Senate

(authored by RSM US LLP) Tax legislation packaging the child tax credit and favorable business tax provisions moves to the Senate with momentum but an uncertain fate.

Continue readingCommercial real estate is high among bankers’ debt concerns

(authored by RSM US LLP) Lenders continue to digest the long-term implications of recent failures as the fallout focus shifts to potential trouble spots.

Continue readingCSB Recognized as INSIDE Public Accounting Top 500

Estate planning and income tax: Key considerations and planning points

(authored by RSM US LLP) You have mapped out your estate plan and feel confident in its estate tax efficiency. However, it is important to consider the income tax ramifications of each decision throughout the planning process to avoid unintended consequences.

Continue readingIRS increases mileage rates for the remainder of 2022

(authored by RSM US LLP) The IRS provides some relief amid rising gas prices with an optional increase to the standard mileage rate for business travel.

Continue readingThe Value Of Strategic Planning

July 9, 2019

Kenny Crow, CPA | Shareholder | Published by Crow Shields Bailey PC

As business leaders, we hear all the time that we need to be managers. We need to work ON our business instead of IN it. This is much more difficult than it sounds. We have to train ourselves to go to work every day to manage a business, not to do the things that the business must do to get the work done.

The fast way to achieve this new role is to hold a Strategic Planning Meeting. Our firm has facilitated several of these meetings. It is a great idea to have someone outside your business to be the discussion leader.

All the key decision makers of the business should attend this meeting. Ultimately, you have to get buy-in and make sure you are all on the same page. It is better to hold the meeting away from the office so you can eliminate any possible distractions with your team members.

The strategic planning meeting should start with a SWOT analysis, making sure to get everyone’s input to determine your strengths, weaknesses, opportunities, and threats. The value of this exercise is to discover what you are good at and what you need to improve upon to help achieve your vision. Next, you discuss the opportunities that exist to obtain your expected level of growth and competitive edge. Finally, you can analyze the threats that exist that could preclude your ability to meet your goals.

Your agenda might include a visioning exercise. Does your vision statement clearly define what the end looks like when you reach maturation? It is critical that your decision makers are all moving toward the same ultimate goal. If not, you have to go through this process or you will be constantly banging your head against the wall.

The results of the SWOT analysis will help you determine which items need to be addressed first. Often, it is a good idea to work with the low-hanging fruit to achieve some early success and get some momentum going. This improvement is a process and can be taxing on your team. Do not try to do everything at once. This can lead to burnout and frustration. Set an agenda for improvement and be diligent about keeping your team focused and committed to the cause.

This process can easily take 18-24 months. The results are that you will be running a business that does not depend on you to be successful and it will outlive you. This in turn makes your business more valuable to a potential buyer because you have built a business that has systems in place to handle the routine things. All of this is possible because you learned the value of working ON your business rather than IN it.

Give us a call if we can help you plan your next Strategic Planning Meeting. We are happy to assist you.

The Big Question: Should You Work At A Large Firm Or A Small Firm?

Kenny Crow, III, CPA | Supervisor | Published by Crow Shields Bailey

Exploring the Benefits and Challenges of Large vs Small Firms

Throughout my career, I have had the pleasure of working for two successful accounting firms. Both of these have provided me with valuable experiences where I have gained a diverse perspective for the unique benefits of working for different sized public accounting firms.

My first job out of college allowed me to work at one of the largest firms in the southeast that was located in Central Alabama. After working in Birmingham for six and a half years, I decided to move to Mobile, AL in early 2018 and began working at Crow Shields Bailey PC (CSB), a mid-size public accounting firm.

Experience level. One of the main differentiators of working in a large vs. small firm is the pace matched with the level of experience you gain. At the start of your career, joining a smaller firm always helps in rapidly gaining a larger breadth of experience. At a firm like CSB, you get to see jobs from start to finish and truly understand the scope of what you are working on in its entirety. In the larger firms, the work is distributed into smaller chunks between more employees, so the experience you gain is narrowed to one focused area or industry.

Big name clients. Working at the larger-sized accounting firm, I was able to partner with some of the largest private companies in the southeast. Partnering with large clients provided the opportunity to support complex financial statements and face issues that could take CPAs at smaller firms many years to obtain a similar level of experience.

Industry expertise. At larger firms, you tend to get concentrated experience in certain industries and work strictly in either audit or tax. This creates an avenue to become a proficient expert in the areas that you specialize in, but prevents you from being able to comprehensively consult with your clients on all accounting-related matters. At CSB and other similar sized firms, you have the opportunity to gain experience in all types of industries and every line of business. This allows you to be your client’s preferred advisor in tax, audit, financial consulting, forensic accounting, and many other matters.

Path to Partner. With the bifurcation of audit and taxes or industry specializations occurring so frequently in large firms, younger CPAs at major firms may find it more challenging to serve their client in every financial consulting facet as they move towards the path of partner. As younger CPAs at larger accounting firms trend towards industry specialization, they have to invest a significant amount of time to staying updated on industry and accounting literature for areas they lack experience in. CPAs in small firms naturally gain this experience and knowledge more quickly as they progress in their “multiple hat” career paths. Many Baby Boomers and Generation X CPAs that are currently serving in a partner-level position began their careers in an environment where they were involved with all levels of business and worked in several types of industries, similar to CSB.

Leadership opportunities. I have also found that as you progress throughout your career path, you have more opportunities in smaller firms to positively influence the firm’s culture and take on leadership roles, but one can still bring invaluable leadership impact to larger firms if you find the right mentors and support teams.

Regardless of the path of public accounting you choose, you can’t go wrong with a career in this industry. Working at both large and small accounting firms has its benefits and the key to choosing the right one is truly understanding the differences between the two and prioritizing what is important to you. If you have any questions or want any additional information about working at a large accounting firm versus a smaller accounting firm, please contact Kenny Crow, III at [email protected].

CSB Team Member Promotions

We would like to congratulate three of our team members for their recent promotions.

Sherri Deighton, CPA on the tax team was promoted to Manager. Sherri’s specialties are in individual, partnership, and corporate tax returns, with expertise in trust and estate tax returns.

Sherri Deighton, CPA on the tax team was promoted to Manager. Sherri’s specialties are in individual, partnership, and corporate tax returns, with expertise in trust and estate tax returns.

Emma Ard on the tax team was promoted to Senior Accountant.

Emma Ard on the tax team was promoted to Senior Accountant.

Blake LaMont on the tax team was also promoted to Senior Accountant.