Crow Shields Bailey Senior Accountant Hunter Young and Staff Accountant Blake LaMont have opted to be official ‘Shoe Guys’ at this year’s Wine, Women & Shoes event benefiting Camp Rap-A-Hope, a summer camp and program offering year-long activities for children diagnosed with cancer.

‘Shoe Guys’ Hunter and Blake will have many responsibilities leading up to and at the event, including a commitment to raise $10,000 dollars for Camp Rap-A-Hope and perform a choreographed dance.

‘Shoe Guys’ Hunter and Blake will have many responsibilities leading up to and at the event, including a commitment to raise $10,000 dollars for Camp Rap-A-Hope and perform a choreographed dance.

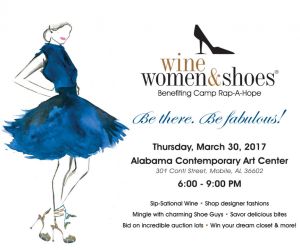

Wine, Women & Shoes will take place at the Alabama Contemporary Art Center on March 30 and is the perfect girls’ night out. The event will feature a marketplace of some of the best boutiques in the area, excellent food and wine, silent auctions, raffles and much more.

To contribute to Camp-Rap-A-Hope, consider purchasing a ticket to Wine, Women & Shoes or donate to Hunter or Blake’s fundraising pages. Thank you for your generosity and we hope to see you there!